All Categories

Featured

Table of Contents

This policy design is for the client who needs life insurance policy yet would love to have the ability to choose just how their money worth is invested. Variable plans are financed by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Associate of National Life Insurance Firm, One National Life Drive, Montpelier, Vermont 05604.

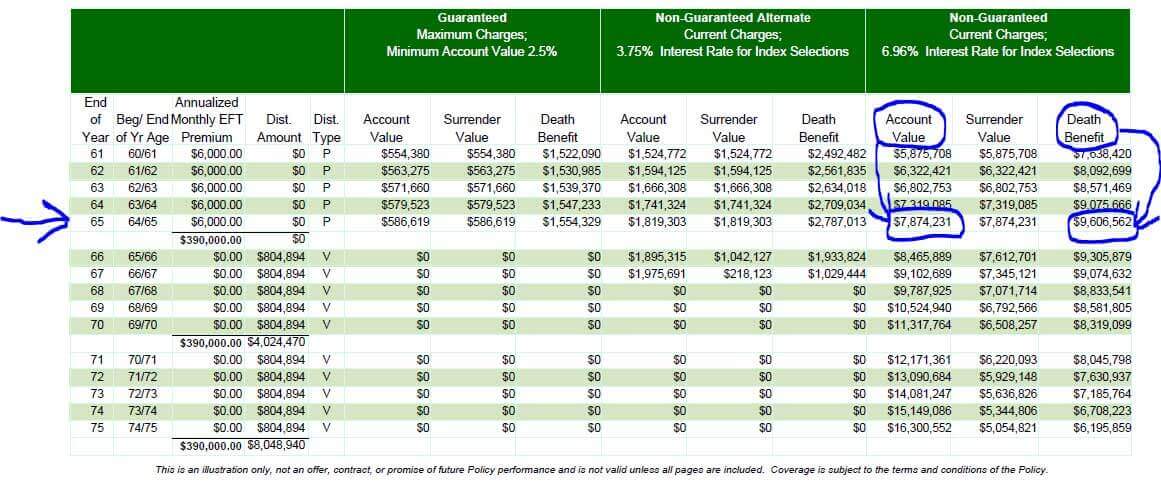

A whole life insurance coverage plan covers you forever. It has cash worth that grows at a fixed rate of interest rate and is one of the most usual sort of irreversible life insurance policy. Indexed universal life insurance policy is also permanent, however it's a particular sort of global life insurance policy with cash worth connected to a stock exchange index's efficiency rather than non-equity earned prices. Then, the insurer will certainly pay the face amount directly to you and end your policy. Contrastingly, with IUL policies, your survivor benefit can enhance as your money worth grows, bring about a possibly higher payment for your beneficiaries.

Discover about the several benefits of indexed global insurance coverage and if this kind of policy is best for you in this insightful short article from Safety. Today, lots of people are checking out the worth of permanent life insurance policy with its capability to supply long-term defense in addition to money value. Thus, indexed global life (IUL) has come to be a prominent choice in giving irreversible life insurance policy security, and an also higher potential for growth with indexing of rate of interest credits.

Where can I find Iul Plans?

Nevertheless, what makes IUL different is the way interest is attributed to your plan. Along with providing a typical proclaimed rates of interest, IUL uses the opportunity to make passion, subject to caps and floorings, that is linked to the efficiency of a picked option of market indices such as the S&P 500, Dow Jones Industrial Standard or the Nasdaq-100.

With IUL, the insurance policy holder selects the quantity alloted among the indexed account and the taken care of account. Just like a regular global life insurance policy plan (UL), IUL enables for a flexible premium. This suggests you can pick to add more to your policy (within government tax legislation restrictions) in order to assist you develop your money value even quicker.

As insurance coverage policies with investment-like functions, IUL plans charge payments and costs. While IUL plans likewise offer ensured minimal returns (which might be 0%), they also cover returns, even if your select index overperforms.

Composed by Clifford PendellThe advantages and disadvantages of indexed universal life insurance policy (IUL) can be hard to make feeling of, specifically if you are not familiar with exactly how life insurance policy functions. While IUL is one of the most popular products on the market, it's likewise one of one of the most unpredictable. This kind of protection may be a practical option for some, however, for lots of people, there are much better choices avaiable.

What does Iul Plans cover?

In addition, Investopedia listings tax benefits in their advantages of IUL, as the death advantage (cash paid to your beneficiaries after you die) is tax-free. This is true, however we will add that it is also the instance in any life insurance plan, not just IUL.

The one thing you require to recognize concerning indexed universal life insurance policy is that there is a market danger involved. Investing with life insurance coverage is a various video game than getting life insurance policy to shield your household, and one that's not for the pale of heart.

For circumstances, all UL items and any basic account item that depends upon the performance of insurance firms' bond portfolios will certainly undergo rate of interest danger."They continue:"There are fundamental dangers with leading clients to believe they'll have high prices of return on this product. A customer could slack off on funding the cash money worth, and if the plan doesn't execute as anticipated, this might lead to a lapse in insurance coverage.

In 2014, the State of New York's insurance policy regulatory authority probed 134 insurance firms on how they market such plans out of problem that they were overemphasizing the possible gains to consumers. After proceeded examination, IUL was struck in 2015 with laws that the Wall surface Road Journal called, "A Dosage of Fact for a Hot-Selling Insurance Coverage Item." And in 2020, Forbes released and article titled, "Sounding the Alarm on Indexed Universal Life Insurance Coverage."Regardless of hundreds of short articles advising customers regarding these plans, IULs remain to be one of the top-selling froms of life insurance coverage in the USA.

Flexible Premium Indexed Universal Life

Can you deal with seeing the stock index choke up knowing that it directly influences your life insurance policy and your ability to safeguard your family members? This is the last intestine check that hinders even extremely well-off capitalists from IUL. The whole point of acquiring life insurance policy is to minimize danger, not produce it.

Find out more regarding term life below. If you are seeking a policy to last your entire life, take a look at guaranteed global life insurance coverage (GUL). A GUL policy is not technically long-term life insurance policy, but rather a hybrid in between term life and global life that can allow you to leave a tradition behind, tax-free.

Your price of insurance policy will certainly not transform, also as you obtain older or if your wellness adjustments. You pay for the life insurance coverage security only, just like term life insurance policy.

What are the benefits of Indexed Universal Life Premium Options?

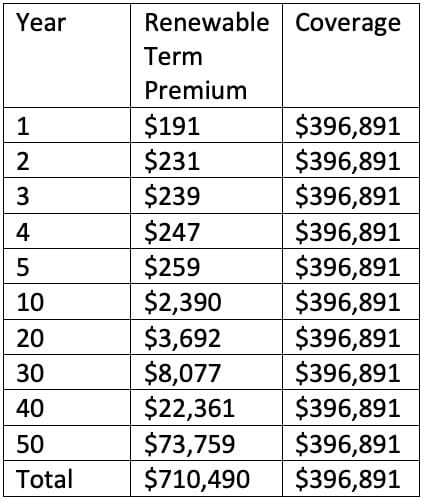

Guaranteed universal life insurance policy is a fraction of the expense of non-guaranteed global life. You do not run the risk of shedding coverage from negative investments or changes out there. For a thorough comparison between non-guaranteed and assured global life insurance coverage, click on this link. JRC Insurance Coverage Group is right here to assist you find the appropriate policy for your needs, without any added cost or cost for our aid.

We can obtain quotes from over 63 top-rated service providers, allowing you to look past the big-box firms that usually overcharge. Consider us a close friend in the insurance policy market that will look out for your finest rate of interests.

Can I get Indexed Universal Life Cash Value online?

He has actually aided thousands of households of services with their life insurance needs given that 2012 and specializes with candidates who are much less than ideal wellness. In his leisure he delights in spending quality time with household, taking a trip, and the open airs.

Indexed universal life insurance policy can assist cover numerous financial demands. It is just one of lots of kinds of life insurance available.

Latest Posts

Wrl Index Universal Life Insurance

Transamerica Index Universal Life Insurance

Guaranteed Universal Life Quotes