All Categories

Featured

Table of Contents

The plan acquires worth according to a dealt with timetable, and there are fewer fees than an IUL plan. A variable policy's money worth might depend on the efficiency of certain stocks or various other protections, and your premium can also change.

An indexed global life insurance coverage plan consists of a survivor benefit, along with a component that is tied to a supply market index. The cash worth growth relies on the efficiency of that index. These policies supply greater possible returns than other forms of life insurance policy, along with higher risks and additional fees.

A 401(k) has even more investment options to choose from and may come with an employer match. On the other hand, an IUL includes a survivor benefit and an additional money worth that the policyholder can obtain versus. They additionally come with high costs and fees, and unlike a 401(k), they can be canceled if the insured quits paying into them.

How do I apply for Indexed Universal Life Calculator?

Nevertheless, these policies can be extra complex contrasted to other kinds of life insurance, and they aren't always appropriate for each financier. Speaking to a seasoned life insurance coverage representative or broker can aid you determine if indexed universal life insurance is a great fit for you. Investopedia does not give tax obligation, investment, or economic services and advice.

Your present browser may limit that experience. You may be using an old browser that's in need of support, or settings within your internet browser that are not compatible with our website.

What are the benefits of Iul Loan Options?

Currently using an updated web browser and still having problem? If you're browsing for lifetime protection, indexed universal life insurance is one alternative you may desire to consider. Like various other permanent life insurance coverage items, these policies permit you to construct money worth you can tap during your life time.

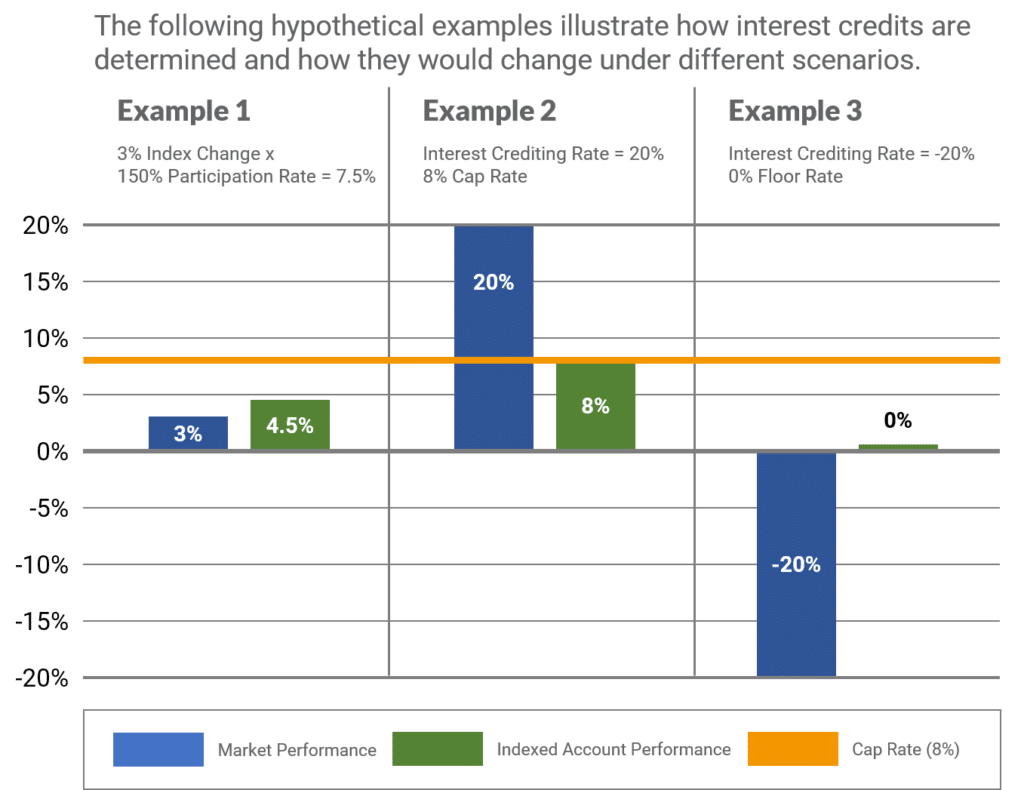

That suggests you have a lot more long-term growth potential than a whole life plan, which provides a set price of return. But you additionally experience much more volatility given that your returns aren't guaranteed. Commonly, IUL policies prevent you from experiencing losses in years when the index sheds value. Nevertheless, they also top your rate of interest credit scores when the index goes up.

Nevertheless, understand the benefits and disadvantages of this item to identify whether it lines up with your financial objectives. As long as you pay the costs, the policy remains effective for your entire life. You can gather cash money value you can utilize throughout your life time for different financial needs. You can adjust your costs and survivor benefit if your situations alter.

How long does High Cash Value Iul coverage last?

Permanent life insurance policy policies often have higher first costs than term insurance, so it may not be the ideal option if you're on a limited spending plan. IUL plans. The cap on interest credit reports can limit the upside possibility in years when the stock market executes well. Your policy could lapse if you get as well large of a withdrawal or policy lending

With the possibility for more durable returns and adjustable repayments, indexed universal life insurance policy may be an option you desire to consider. If taken care of yearly returns and locked-in costs are very important to you, a whole life policy might represent the far better selection for irreversible coverage. Curious to discover which insurance coverage product suits your demands? Reach out to an economic specialist at Colonial Penn, who can review your personal circumstance and provide customized insight.

Perfect for ages 35-55.: Offers versatile insurance coverage with modest cash money worth in years 15-30. Some things customers ought to consider: In exchange for the death advantage, life insurance products charge costs such as death and cost danger charges and abandonment costs.

Insurance policy holders can lose cash in these items. Policy lendings and withdrawals may create a negative tax lead to the event of gap or policy abandonment, and will certainly lower both the abandonment worth and death benefit. Withdrawals may undergo taxes within the very first fifteen years of the contract. Customers should consult their tax obligation expert when considering taking a policy lending - Indexed Universal Life for wealth building.

Is there a budget-friendly Iul Investment option?

It must not be taken into consideration investment suggestions, nor does it constitute a suggestion that any individual participate in (or avoid) a certain strategy. Securian Financial Group, and its subsidiaries, have a financial interest in the sale of their products. Minnesota Life Insurance Policy Company and Securian Life Insurance policy Firm are subsidiaries of Securian Financial Team, Inc.

IUL can be utilized to save for future requirements and supply you with a home mortgage or a secure retirement preparation car. Which's on top of the cash round figure paid to your loved ones. IUL gives you money worth growth in your lifetime with securities market index-linked investments yet with resources protection for the rest of your life.

To understand IUL, we first need to simplify into its core parts: the money worth element the survivor benefit and the cash value. The fatality advantage is the amount of money paid to the policyholder's beneficiaries upon their passing away. The policy's cash-in value, on the various other hand, is a financial investment element that grows with time.

How do I cancel Iul Premium Options?

See the section later in this article. However, whilst plan withdrawals are valuable, it is essential to monitor the policy's performance to ensure it can maintain those withdrawals. Some insurance firms also restrict the amount you can withdraw without minimizing the survivor benefit quantity. However, this access to your capital is an attractive feature.

The economic security needed focuses on the capability to deal with superior repayments easily, despite the fact that IUL plans use some flexibility.: IUL policies permit flexible premium payments, providing insurance policy holders some leeway on just how much and when they pay within set limits. Despite this versatility, constant and appropriate financing is vital to maintain the policy in good standing.: Policyholders ought to have a steady earnings or adequate savings to ensure they can satisfy superior needs gradually.

Is Flexible Premium Iul worth it?

You can pick to pay this passion as you go or have the rate of interest roll up within the policy. If you never pay back the financing during your lifetime, the survivor benefit will be minimized by the amount of the superior funding. It suggests your beneficiaries will receive a lower quantity so you may want to consider this before taking a plan funding.

It's vital to monitor your cash money worth equilibrium and make any kind of necessary changes to stop a plan lapse. Life plan forecasts are a crucial tool for recognizing the prospective efficiency of an IUL policy. These projections are based upon the forecasted rate of interest prices, costs, payments, caps, participation price, rates of interest used, and finances.

Latest Posts

Why should I have Indexed Universal Life Financial Security?

Why is Indexed Universal Life Investment important?

How do I get Iul Financial Security?